Credit Risk Software Solutions

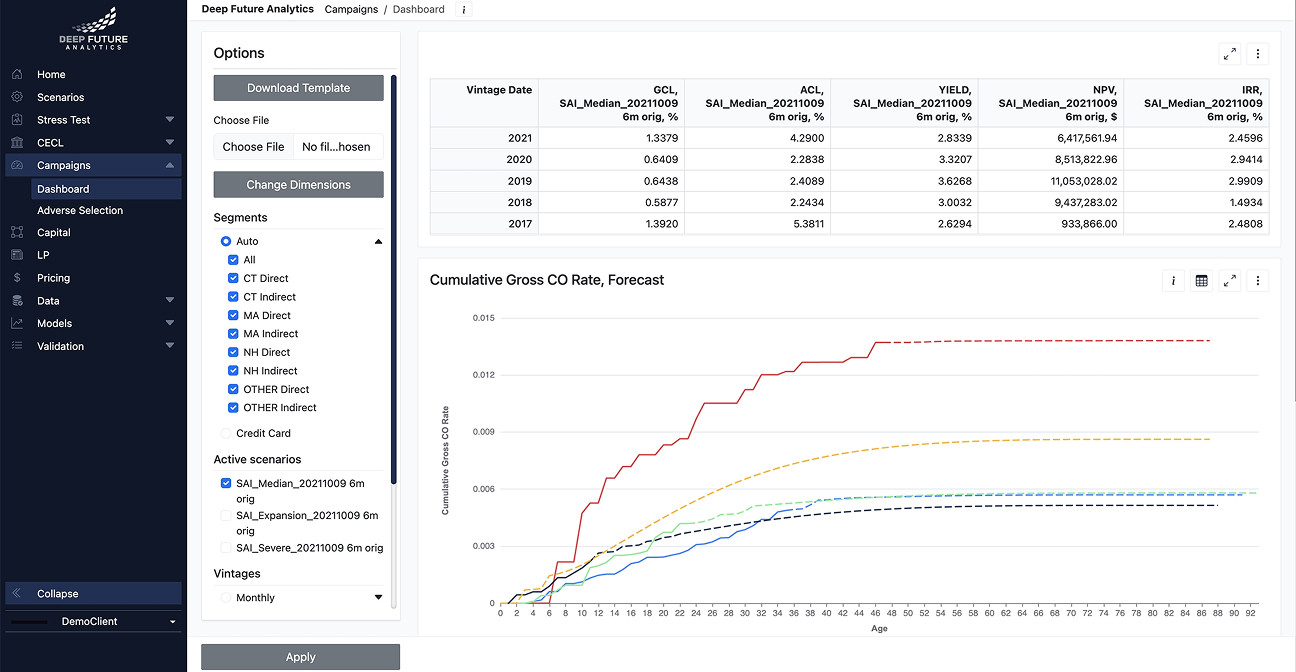

including delinquency, loss, and profitability; vintage-based analysis and forecasting; through-the-door distribution shifts; pricing sensitivity

for Retail Portfolios (Personal Loans, Cards, Auto, Mortgages, Small Business Loans)

credit risk modeling for transparent financial reporting.

including credit loss, yield, and NPV for smarter capital allocation.

for Risk-based pricing and Cut-off score optimization to balance risk, returns, and growth

Selection Benchmarking

for all loan types to aid in competitive analysis and loan origination strategy

Early Warning / Opportunity

A panel-based Origination Score connects directly to PD through the lifecycle

Coming Soon

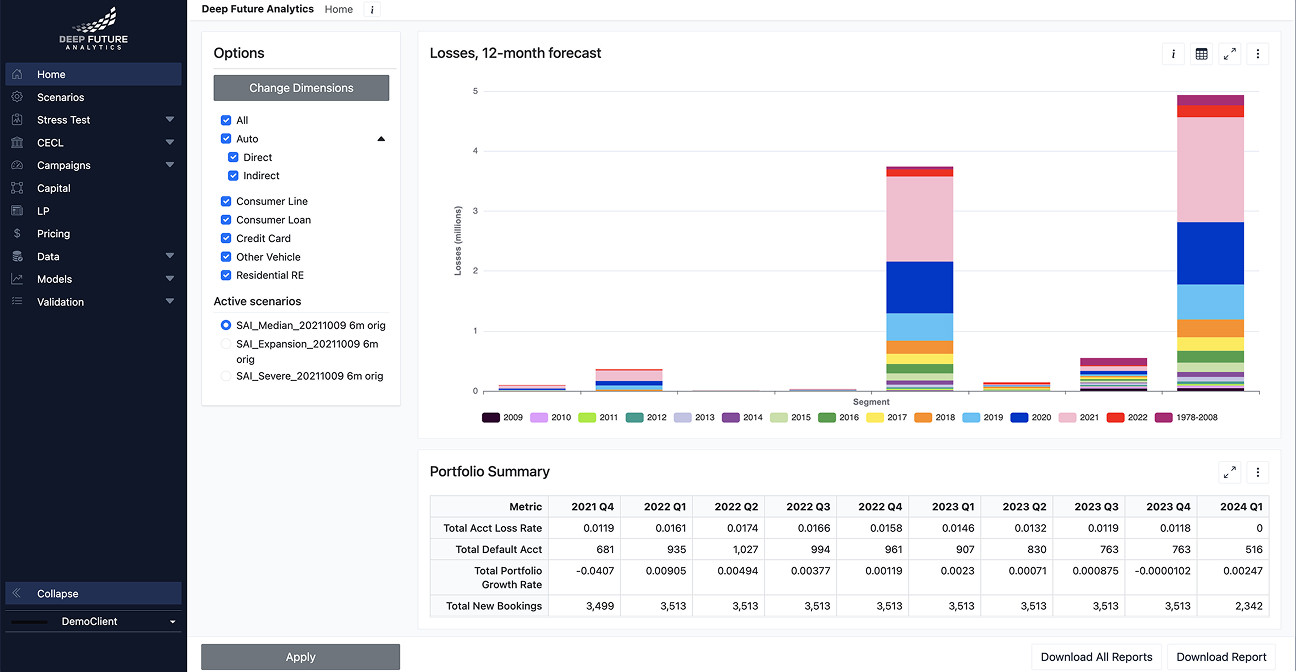

Retail Portfolio Analytics

including delinquency, loss, and profitability; vintage-based analysis and forecas- ting; through-the-door distribution shifts; pricing sensitivity

Stress Testing

for Retail Portfolios (Perso- nal Loans, Cards, Auto, Mortgages, Small Business Loans)

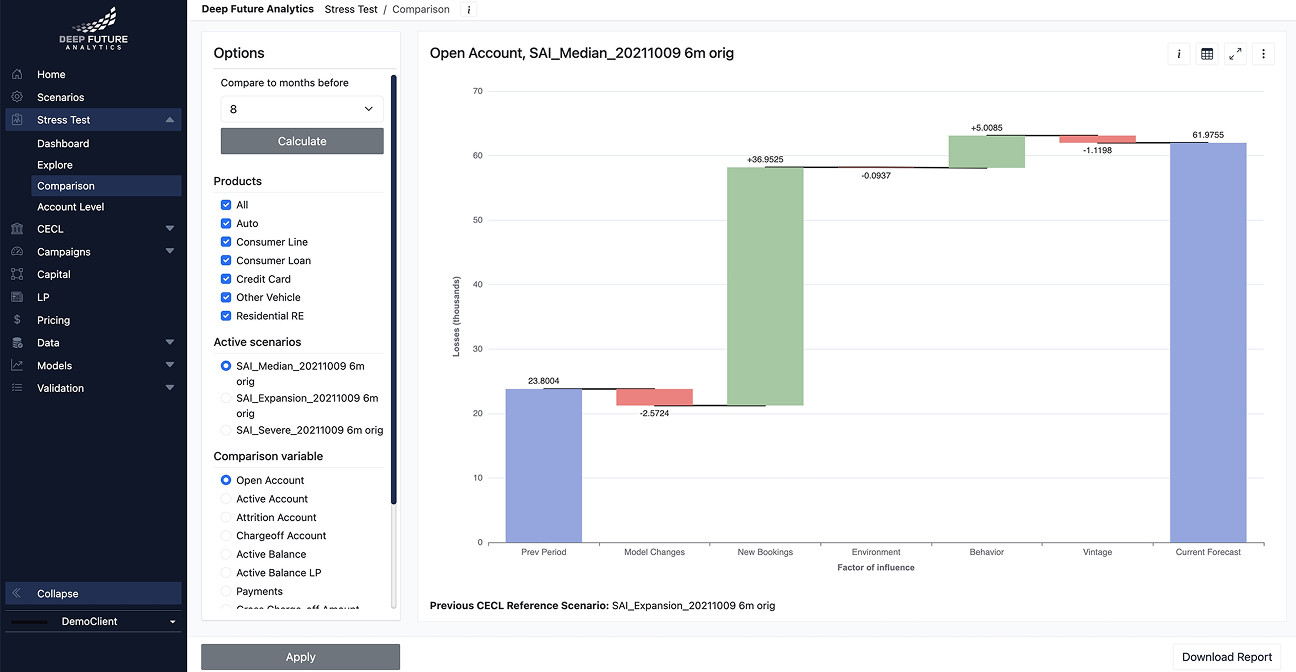

World-Class Stress Testing

DFA has developed a rich library for automatic creation Age-Period-Cohort models. These have been extraordinarily successful through crises over the last 30 years.

Climate Risk Stress Testing

The climate risk literature was written by insurance companies. Bank loan portfolios must worry most about Age-Period-Cohort models.

DFA Models

- Climate Scenarios

- Economic Scenarios

- Climate Event Probabilities

- Portfolio Stress Tests

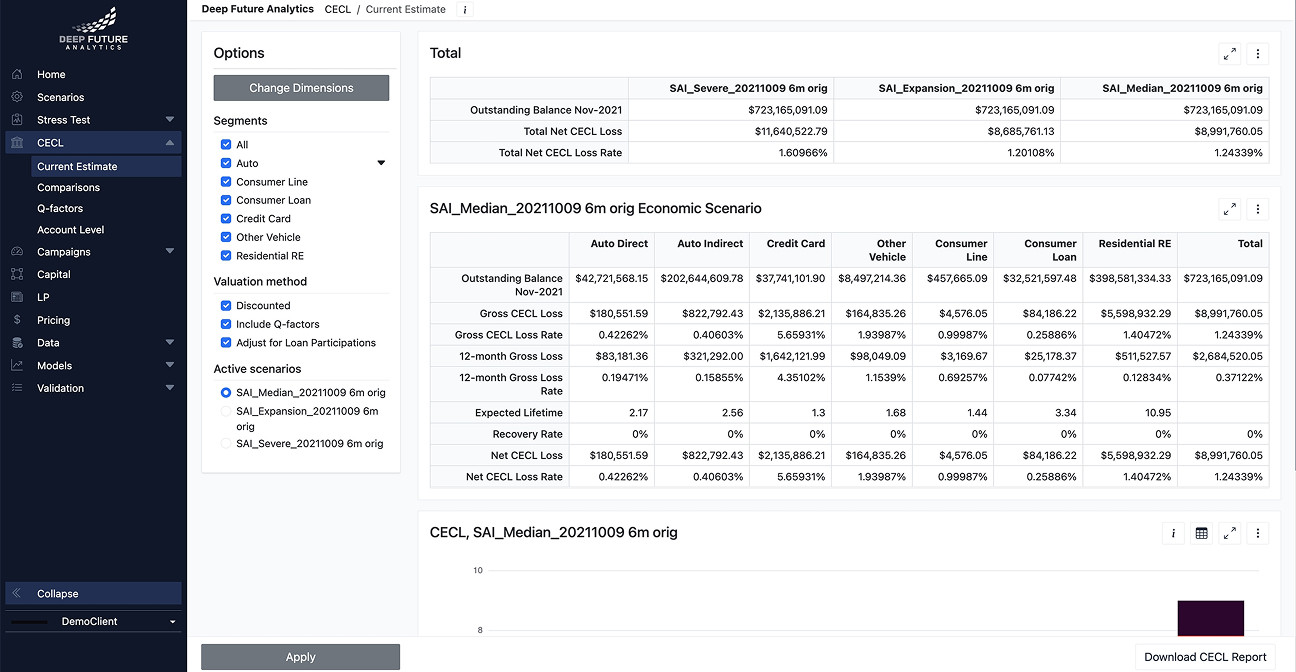

IFRS 9 & CECL

credit risk modeling for transparent financial reporting.

- Our scenario-driven, loan-level, cash flow models for CECL and IFRS 9 are an analytics platform investment, enabling a broad range of future uses.

- Our technology creates one model for all IFRS 9 stages, avoiding the staging biases plaguing common approaches; and exports reports to any platform.

Effectively calibrating reserves to the economic environment is an enabler to lending strategy.

Yield Forecasting

including credit loss, yield, and NPV for smarter capital allocation.

The Bigger Goal – NPV Forecasting

The origination and behavior scores are designed to integrate with a cash flow forecast to predict account-level NPV At origination, NPV thresholds can be set to decide whether to make or change an offer.

Account-level Forecasting

Whether logistic regression or advanced ML/AI, our patented approach blends portfolio insights from vintage analysis with machine learning’s nonlinear strengths. Predicts the timing of prepayment, loss, revenue & expense rolled up to yield, NPV, IRR at the account level.

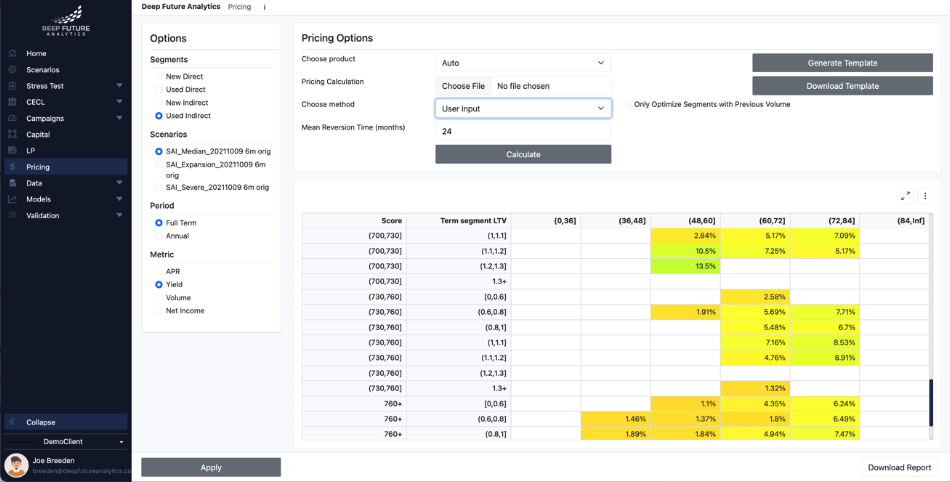

Pricing Optimization

for Risk-based pricing and Cut-off score optimization to balance risk, returns, and growth

Risk-Based Pricing

- Cut-off Score Optimization, Pricing Optimization, CLI / CLD Optimization.

- Can be used to estimate competitor yields, run pricing tests, or use our optimizer for yield – demand trade-offs.

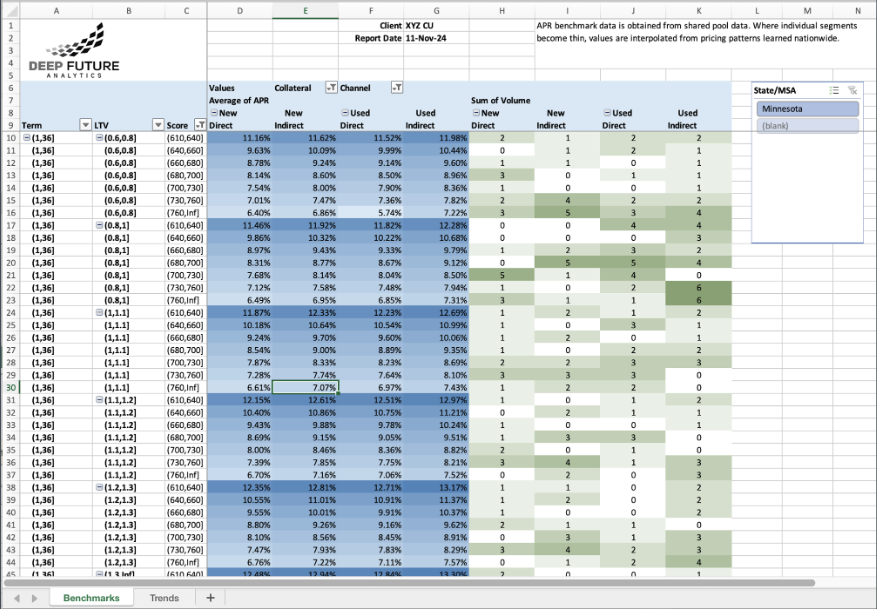

APR and Adverse Selection Benchmarking

for all loan types to aid in competitive analysis and loan origination strategy

Industry Benchmarking

- APR benchmarks for all product types with detailed segmentation

- Adverse selection benchmarking to track trends in borrower risks

- Aids in competitive pricing and loan origination strategy

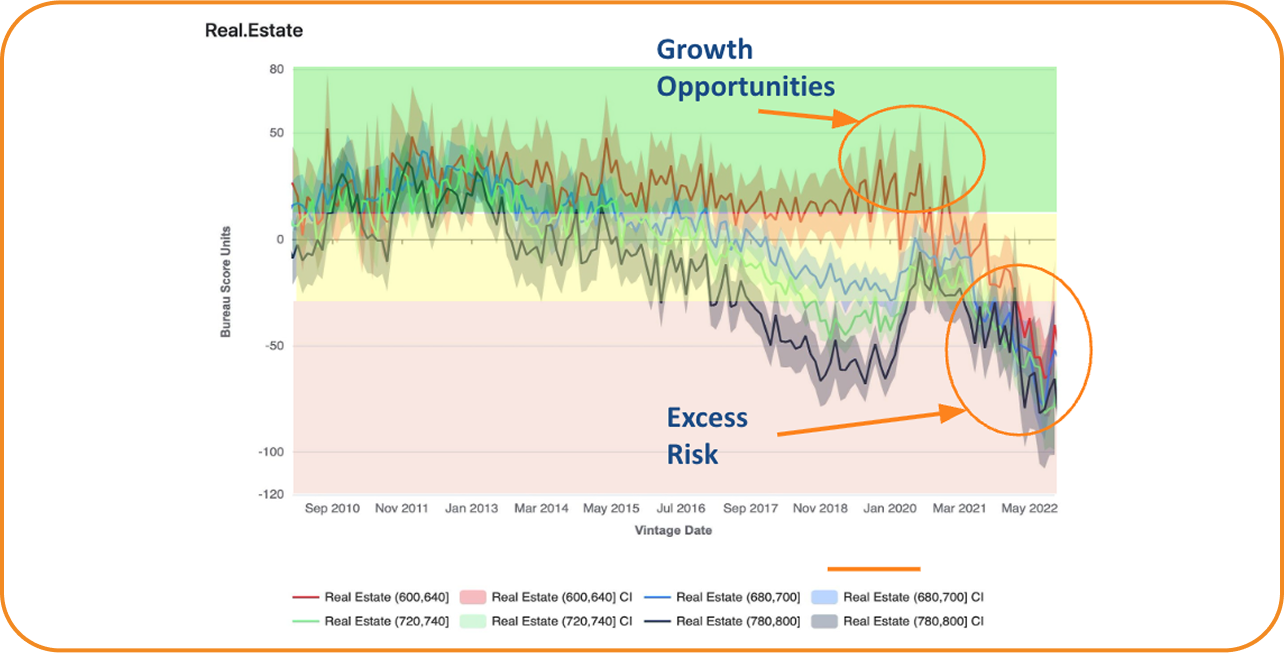

Adverse Selection

Early Warning / Opportunity

- A panel-based Origination Score connects directly to PD through the lifecycle.

- Therefore we can rapidly measure residual risk shortly after origination.

- The greatest business value is rapidly course-correcting in a growing portfolio.